FinCrime Modernization: Do You Have A Plan?

Scottsdale, Arizona, June 14, 2022 – i3strategies®️, a boutique consultancy with unique expertise in the Financial Crime Risk and Compliance space, is pleased to present our latest blog post.

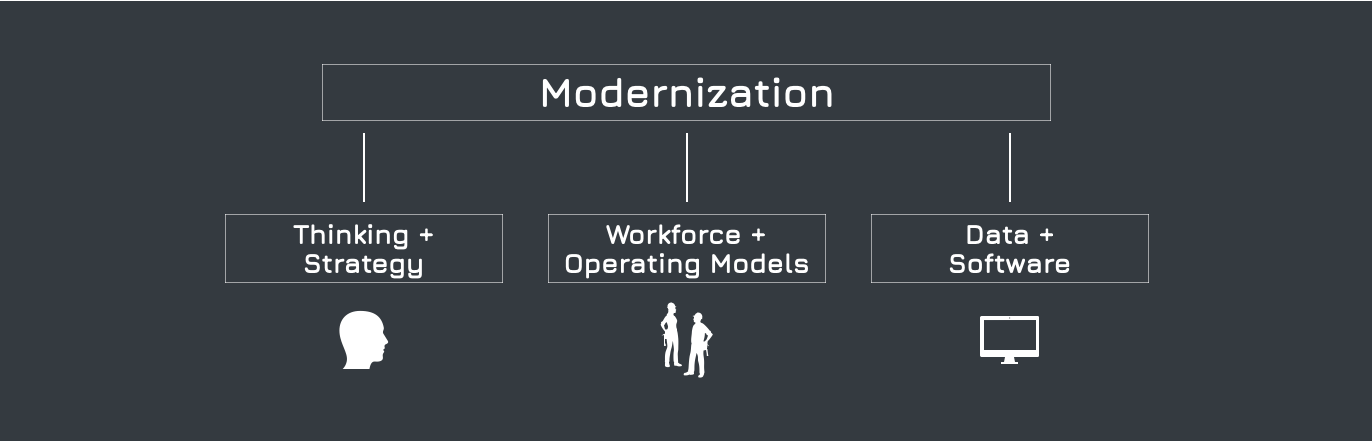

When Financial Crime Risk and Compliance professionals think about modernization, most picture new software alleviating inefficient, monotonous parts of alert, investigations, and due diligence work. And hopefully, it will. But the push to modernize is also an opportunity to assess every aspect of a program, not just technology.

Modernization is an opportunity to rethink policies, procedures, processes, organization structures, reporting lines, and operating models. Modernization is a time to strengthen a workforce and give workers new and better career opportunities. Yes, think about new software, data, and systems, but to only think of modernization in this way means missed opportunities to truly improve a program, detect more suspicious activity, and provide better careers for your team.

Asking the Right Questions

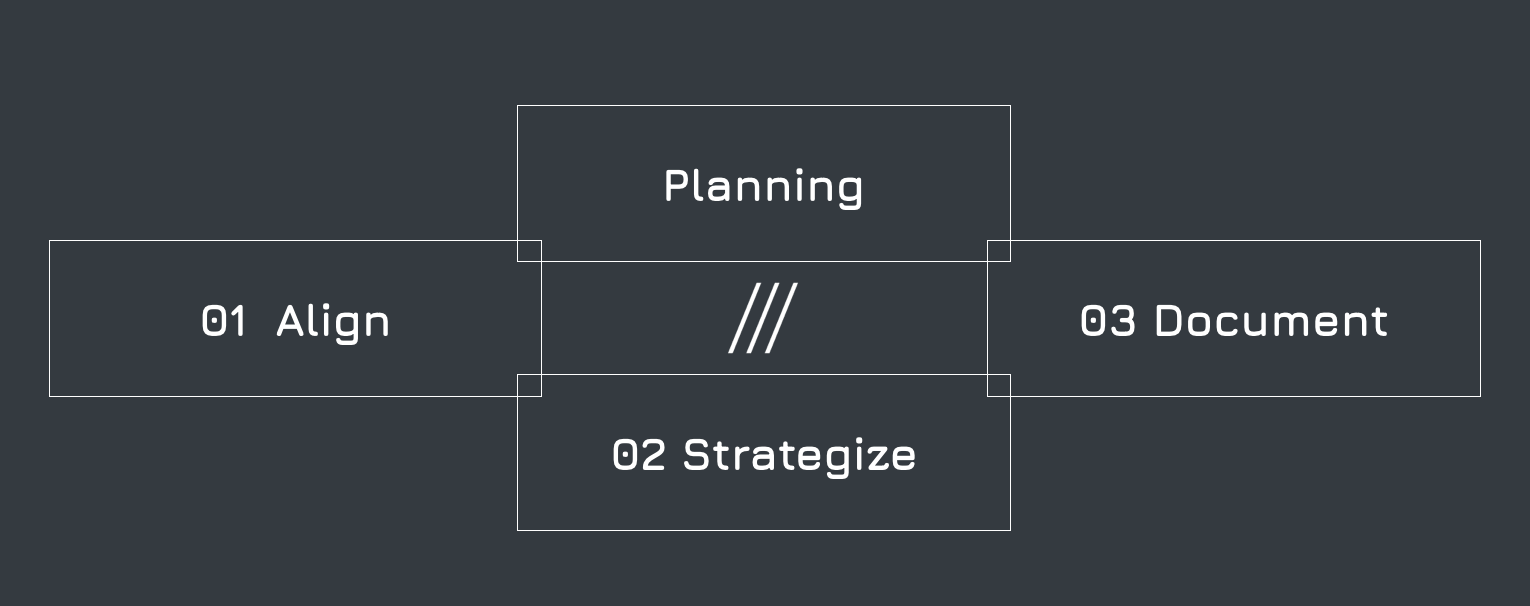

Does your team have a three-year written plan that lays out a clear vision for where the program needs to be? Do you have a step-by-step map for how you get there? Will you be using the same software then as you do today? If not, how are you going to select the new software? What are the requirements? Have you secured a budget?

Separate from new software, do you have a workforce plan for the next three years? Will you need more people, fewer, or the same number? Are existing skills sufficient? How do you find, recruit, hire, and train new workers to replace the 20% - 30% (or more) of staff who will leave in the next three years? How do you provide career development and promotion opportunities?

Are you breaking down each process from identity verification to SAR filing, asking what works well and what doesn’t? What policy, procedure, and process changes are possible where no new technology is required. What is the plan to make these changes happen?

What new processes and procedures are needed if you implement new software? What training is required?

Have you briefed auditors and regulators on the changes you plan to make over the next three years? How often do you brief senior management and the board of directors on your three-year plan?

Are you working with the lines of business to understand their future plans? Do you know their strategies and what new products they will unveil, new customer segments they will pursue, and new locations where they will operate? Do the lines of business know what you are doing in the next three years and how new software and processes involving identity verification, due diligence, and monitoring will impact their staff?

Running the Business

If you are a Financial Crime Risk and Compliance executive, it’s essential to think of what you do as running a business. Granted, compliance operations don’t have a profit and loss statement, but they do have specific business objectives. These include protecting the organization from regulatory, legal, and reputation risk, making it safe for lines of business to focus on generating revenue.

For businesses to survive, they must concern themselves with growth. Financial Crime Risk and Compliance must grow too. Growth doesn’t mean finding revenue in this case but finding better ways to fulfill compliance and operational requirements more effectively and efficiently.

The emphasis on modernization allows leaders to make needed changes, strengthen programs, and better support the revenue side of their institutions. Make a plan to make it happen.