Winning FinCrime Software Sales, Q1-2023

Scottsdale, Arizona, November 15, 2022 – i3strategies®️, a boutique consultancy with unique expertise in the Financial Crime Risk and Compliance space, is pleased to present our latest blog post.

For newer FinCrime Compliance technology companies, will 2023 be the last chance to achieve the recurring revenue needed to survive? For established FinCrime Compliance technology companies, will 2023 be a year to fortify your market share or watch it dwindle? Whether fighting to survive or grow, here are some actions to make 2023 selling successful.

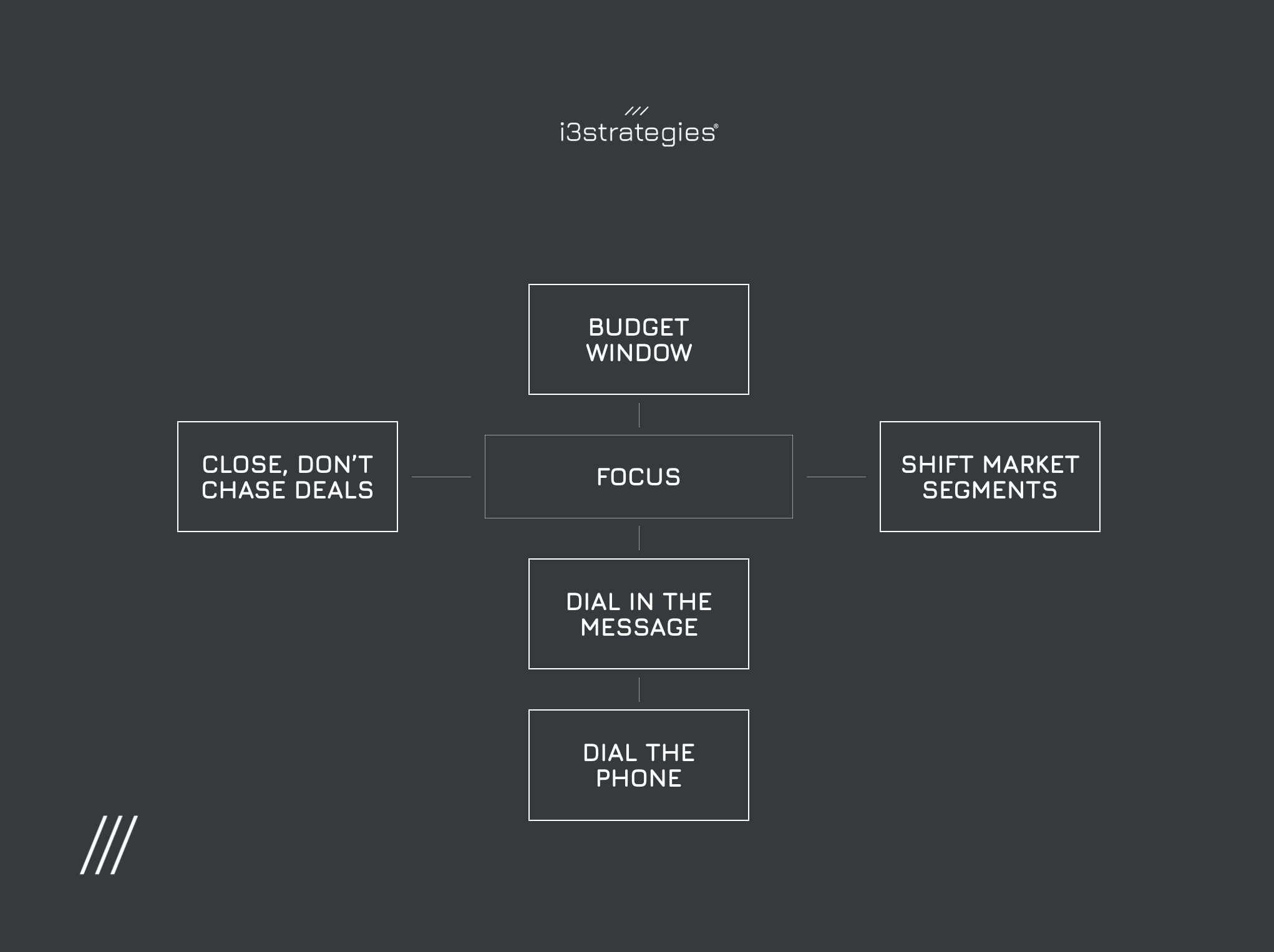

Be In The Budget

Traditional financial institutions have a formal annual budget process that allocates funds for the upcoming year. The 2023 budget window is closing, if it's not already closed. Find prospects who still need to finalize their budgets and get a meeting with them now. You will need to accelerate the sales cycle. Ask if they are willing to consider this. If they are not, decide if pursuing a deal with a prospect with no 2023 budget is worth your time. If you are working at a start-up that is either bootstrapping or whose funding won't last twelve months, ask what sense it makes to continue this pursuit. For established providers, nurturing a long sales cycle is built into your projections, but still get into the prospect's 2023 budget.

Drop Deals

Only pursue deals that will close. Experienced salespeople have good instincts (otherwise, they wouldn't be experienced). Trust those instincts. Look hard at each deal in your pipeline and think critically about its chance of success. Fight the urge to hope it works out. Cut the deals that won't close and let the prospect know you are breaking up. Be polite about it and explain why. If there is any hope of a deal, this is often the only way to close it—something about a seller walking away ignites some buyers to act.

Double-check that you are speaking with the person who has purchasing authority. Ask good questions and dig a bit to ensure you devote your time to someone who can make the deal happen. We realize pushing a prospect to verify their status and authority can be awkward, but you must do it.

Shift Markets

Financial institution sales cycles are long. If your product has no budget this quarter or the next, plan to wait at least a year. Seek out prospects not governed by rigid budgeting bureaucracy. How is your planning and execution for pursuing fintechs, payment processors, and cryptocurrency businesses? If you sell FinCrime Compliance software, these organizations have similar needs to traditional financial institutions and have shorter sales cycles. Not yet under the yoke of annual budgeting constraints, newer companies can act quicker, and many have urgent screening, monitoring, and investigation needs.

Sharpen Your Message

Look at your marketing and messaging. Is it simple and easy to understand? Is it littered with software jargon that confuses non-technical buyers? Is it personalized to specific prospects and their unique business needs?

Be thoughtful about marketing that declares miracle false positive reduction numbers. False positives remain a big problem, but buyers are numb to the message - they've seen it too much for too long. However, if your product does have a proven record of reducing false positives, can you get that client to provide a testimonial? Clients are often reluctant to permit using their institution's name in your promotion, but can they offer a warm introduction to other buyers in their network?

We're in a recession. Mortgage lending is off by record numbers, business lending is slowing, payment volumes are decreasing, crypto prices have cratered, and financial institutions of all types see reduced earnings. Is your marketing message taking this into account? Are you trying to sell to companies who are fighting to stay alive? There are better uses of your time than this. Find financially strong prospects and help them use the downtown to strengthen and better position themselves for the return to growth.

Get creative with how you market. Can you produce a three-minute product video that captures buyers' attention and generates interest? Come up with something beyond the typical video storyline: "AML is a massive worldwide problem; Failure to comply is costly; Buy our product, and you will comply and not be fined." Like claiming to reduce false positives, this storyline is boring and makes you sound like every other product.

Phones Also Make Calls

Salespeople lean on emails and texts. It's easier for a salesperson to write and for a buyer to read a message. But consider something unusual these days - pick up the phone and call. While email may feel more efficient, it is also a shield to hide behind. For sellers, sending a "checking in to see how things are going" email feels like a positive step, but ask yourself, how often do these move a sale forward? For a reluctant buyer, receiving an email is easy too. They don't have to say "no"; they can respond with "we're still reviewing and will get back to you soon." A timid seller and reluctant buyer can keep this going for months. Picking up the phone is going to get you an answer sooner. If the answer is "no," you should want to know that now. Spend your time and emotional energy on pursuits that have a chance.

Friday afternoons are for sales. Decision-makers are often in their office, not stuck in meetings. Things are quieter, and they have time to take phone calls. And remember, the Friday after Thanksgiving. Many AML leaders are there that day to catch up on work and give their teams a day off.

The last prolonged economic downturn was over twelve years ago. Many in FinCrime Compliance have never struggled through such difficult circumstances. For sellers, don't underestimate the challenges. Keep focused, and refine your sales approach, messaging, and how you spend your time. For more on how to sell FinCrime Compliance software, read this.