Newsletter, 13th ed.

Welcome to the 13th Edition of Perspective, by i3strategies®️.

Thank you to everyone who reads and subscribes to our newsletter.

If you are new to this newsletter, here is a quick introduction:

i3strategies®️ is a market research and strategy consulting firm with niche expertise in Financial Crime Risk and Compliance. Our expertise spans across Anti-Money Laundering, Anti-Corruption and Bribery, Sanctions, Fraud, and Cybercrime.

Our commercial focus is on clients in Finance, Tech, Professional Services, Private Equity, and Venture Capital.

This newsletter covers the business and strategy sides of Financial Crime Risk and Compliance. Enjoy the read, and thank you!

Investments, Mergers and Acquisitions

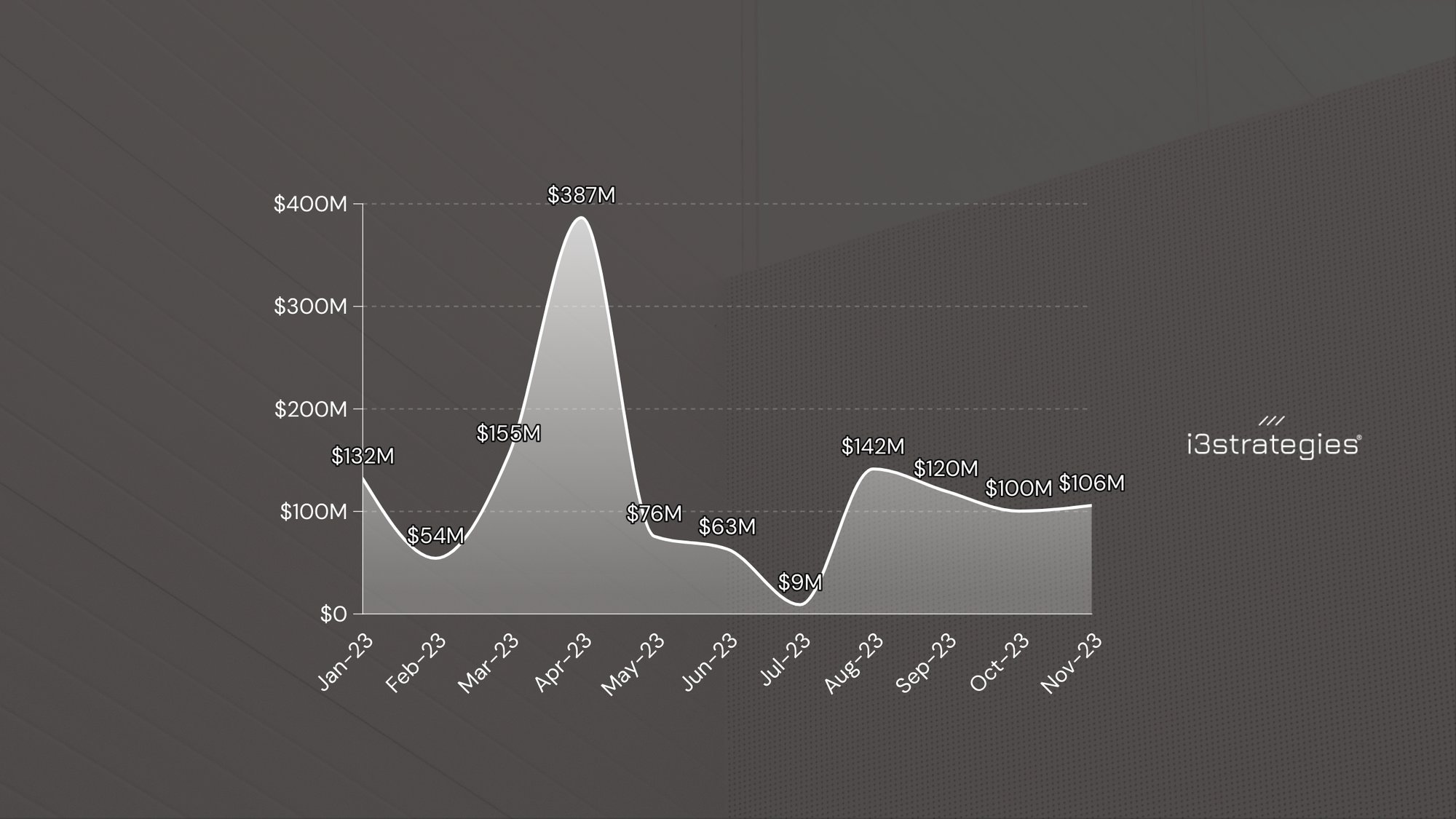

We have tracked YTD, $1,358,027,000 in investments announced in software companies providing solutions for the Financial Crime Risk and Compliance space.

Here are the four (4) investments, totaling $105,800,000, announced in November 2023:

1/ Greenlite announced a $4.8M seed round.

2/ Refine Intelligence announced a $13M seed round.

3/ Lynx Tech announced an $18M Series A round.

4/ BioCatch received $70M in secondary markets funding.

In addition, there were two (2) acquisitions announced in November 2023:

1/ Bain Capital announced the acquisition of Guidehouse for $5.3B.

2/ Certn announced the acquisition of Trustmatic for undisclosed terms.

Innovation News

Here is a quick recap of recent rebranding, partnerships, product releases, and innovation happening across the Financial Crime Risk and Compliance solutions landscape.

1/ Quantexa rebrands recently acquired AYLIEN to Quantexa News Intelligence and announced a significant new product release that helps improve the news API functionality. Read more here.

2/ Kinectify and Quantifind partner to deploy AI-based Watchlist, PEP, and Negative News monitoring service. Read more here.

3/ SymphonyAI Sensa-Net Reveal introduces breakthrough predictive and generative AI-powered case management for financial crime investigation in Asia Pacific. Read more here.

4/ LSEG now offers 5 interoperable capabilities across LSEG Risk Intelligence solutions. Read more here.

5/ Abrigo and Mitek Systems partner to enhance fraud detection for financial institutions. Read more here.

6/ Stout announces new partnership with Chainalysis. Read more here.

Market Analysis

As we sort out a more quantitative methodology for the analysis, we remain confident that this market is stable. Moreover, our bold prediction is that we will see an uptick in investment announcements heading into 1Q'24. Stay tuned for more refined analysis as we go and be on the lookout for our year-in-review publication that will release in January 2024.

Strategy

For finance and tech leaders here are some strategy topics that we recently wrote about:

Fraud is back in vogue, but what's new with this age-old financial crime issue? Join the conversation here.

Regulation, supervision, and enforcement are the pillars of a continuing failed strategy to combat financial crime. Join the conversation here.

Stop overcomplicating the design, implementation, and scaling of financial crime risk and compliance programs. Join the conversation here.