Newsletter, 14th ed.

Welcome to the 14th Edition of Perspective, by i3strategies®️.

Thank you to everyone who reads and subscribes to our newsletter.

If you are new to this newsletter, here is a quick introduction:

i3strategies®️ is a market research and strategy consulting firm with niche expertise in Financial Crime Risk and Compliance. Our expertise spans across Anti-Money Laundering, Anti-Corruption and Bribery, Sanctions, Fraud, and Cybercrime.

Our commercial focus is on Finance, Tech, Professional Services, Private Equity, and Venture Capital clients.

This newsletter covers the business and strategy sides of Financial Crime Risk and Compliance. Enjoy the read, and thank you!

Investments, Mergers and Acquisitions

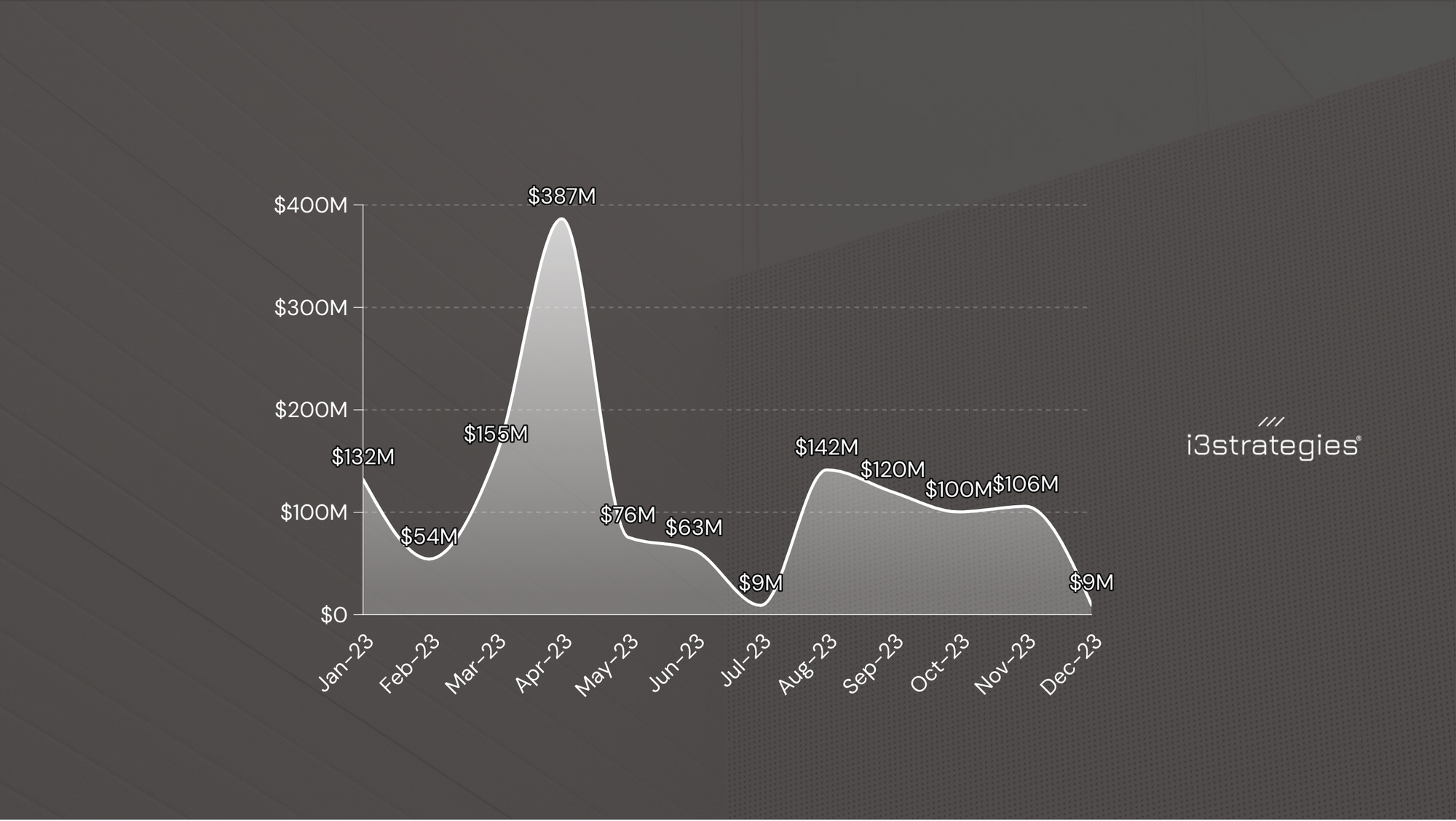

During 2023, we tracked nearly $1.4B in investments announced in software companies providing solutions for the Financial Crime Risk and Compliance space.

Here are the two (2) investments, totaling $9,279,000, announced in December 2023:

1/ ThreatMark announced a $5M venture round.

2/ Salv announced a $4.279M seed round.

In addition, there were two (2) acquisitions announced in December 2023:

1/ Carlyle and Insight Partners announced their majority investment/acquisition of Exiger for a reported valuation of $1.2B.

2/ Ncontracts announced the acquisition of Quantivate for undisclosed terms.

Innovation News

Here is a quick recap of recent rebranding, partnerships, product releases, and innovation happening across the Financial Crime Risk and Compliance solutions landscape.

1/ Flagright (Product Update) has unveiled its latest innovation, Quality Assurance. This groundbreaking development is set to redefine the standards of efficiency and accuracy in the financial industry. Read more here.

2/ Ripjar (Product Update) announced that AI summaries were added to AI risk profiles. Read more here.

3/ DataVisor (Product Update) announced the expansion of its end-to-end platform capabilities with the integration of SMS customer verification for fraudulent transactions (powered by Twilio). Read more here.

4/ Middesk and Hummingbird partner to streamline customer diligence and compliance for modern financial institutions. Read more here.

5/ WorkFusion and Thomson Reuters announced a partnership to help US organizations prevent fraud and more effectively uncover and manage hidden risks. Read more here.

6/ Certa and Castellum AI announced a partnership to help compliance and procurement professionals access the most accurate, reliable, and fastest information on sanctions, export controls, adverse media, beneficial ownership, and more. Read more here.

7/ Napier and KYC Portal announced a partnership to help eliminate siloes across compliance operations by seamlessly integrating KYC and compliance processes. Read more here.

Market Analysis

Stay tuned as we publish the 2023 Year-in-Review Market Update later this month.

Strategy

For finance and tech leaders here are some strategy topics that we recently wrote about:

A modern approach to managing financial crime risk starts with an encompassing strategy around cybercrime, fraud, corruption, money laundering, and sanctions. Join the conversation here.

In 2024, fraudsters, professional money launderers, corrupt actors, sanctions evaders, and cyber-criminals will become more sophisticated in their tactics. Still, they will likely maintain conventional strategies that have stayed ahead of our efforts to thwart financial crime for decades. Join the conversation here.

🎧 Listen → The Perspective Podcast with Vic Maculaitis on Spotify or Apple.

🤝 Engage → Perspective with Vic Maculaitis open hours.